Maximum Fsa 2025. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.

For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

In 2024, Employees Can Contribute Up To $3,200 To A Health Fsa.

If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025.

On May 9, 2024 The Internal Revenue Service Announced The Hsa Contribution Limits For 2025.

On may 9, 2024 the internal revenue service announced the hsa contribution limits for 2025.

Maximum Fsa 2025 Images References :

Source: formspal.com

Source: formspal.com

Form Fsa 2025 ≡ Fill Out Printable PDF Forms Online, To contribute to an hsa, you must be enrolled in an hsa. Any federal, payroll, or state taxes (depending on your state).

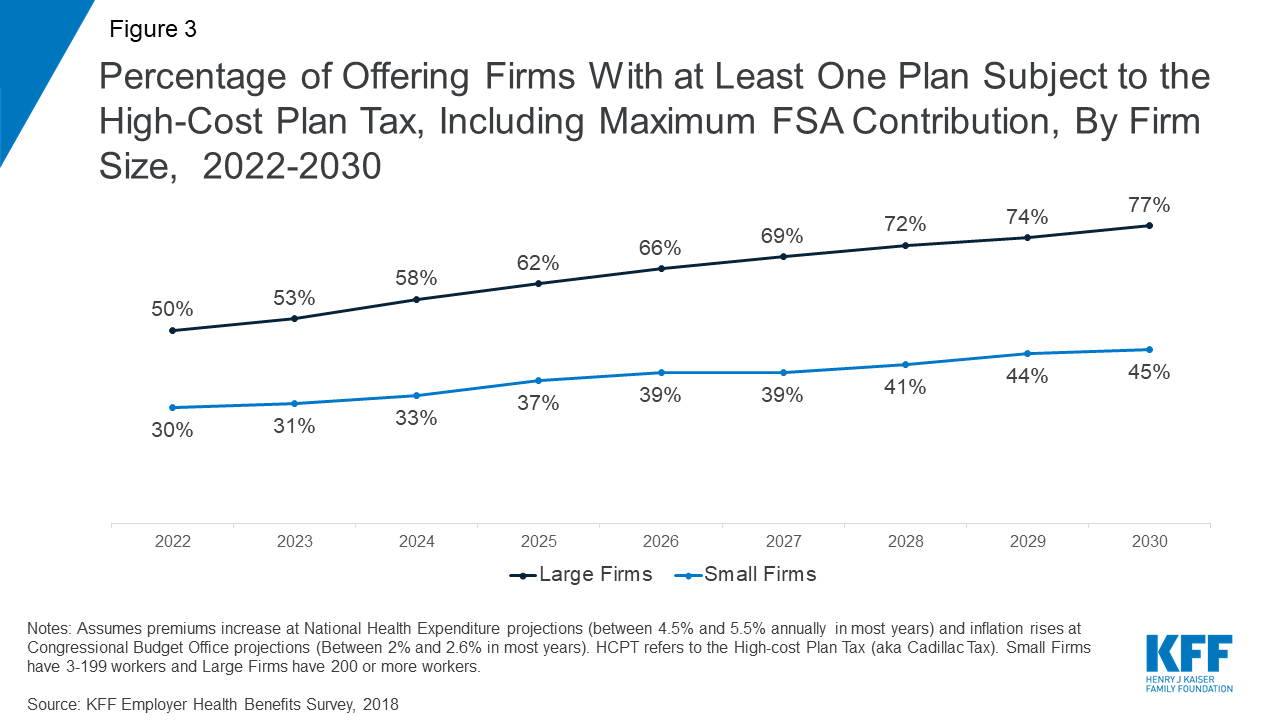

Source: www.kff.org

Source: www.kff.org

How Many Employers Could Be Affected by the HighCost Plan Tax KFF, Fsa contribution limits 2023 2024 fsa maximum. The 2024 maximum fsa contribution limit is.

Source: billyeqjulita.pages.dev

Source: billyeqjulita.pages.dev

What Is The Max Fsa Contribution For 2024 Wendy Joycelin, For 2025, the hsa contribution limit is $4,300 for an individual, up from $4,150 in 2024. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Fsa Dependent Care Limit 2025 Candis Roxanne, Learn what the maximum fsa limits are for 2024 and how they work. The 2024 maximum fsa contribution limit is.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Each year the irs announces updates to contribution limits for flexible spending accounts (fsa), health savings accounts (hsa), health. Irs releases health savings account limits for 2025.

Source: www.uprootedacademy.org

Source: www.uprootedacademy.org

20242025 FAFSA How to Obtain an FSA ID Without a Social Security Number, On may 9, 2024 the internal revenue service announced the hsa contribution limits for 2025. For 2025, the hsa contribution limit is $4,300 for an individual, up from $4,150 in 2024.

Source: www.golocalprov.com

Source: www.golocalprov.com

GoLocalProv IRS Updates 2023 Limits for HSAs, HDHPs, and HRAs, But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). Fsa contribution limits 2023 2024 fsa maximum.

Source: wilienadean.pages.dev

Source: wilienadean.pages.dev

Fsa Maximum 2024 Irs Lynn Sondra, For unused amounts in 2023, the maximum amount that can. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2024 Health FSA Limit DSP, For 2025, the hsa contribution limit is $4,300 for an individual, up from $4,150 in 2024. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

Healthcare Fsa Maximum 2025 Evvy Peggie, The 2024 maximum fsa contribution limit is. On may 9, 2024 the internal revenue service announced the hsa contribution limits for 2025.

The Internal Revenue Service (Irs) Announced New Cola Adjustments And Maximum Fsa Contribution Limits For 2025.

The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

Learn What The Maximum Fsa Limits Are For 2024 And How They Work.

For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.